If you’re a MarTech news junkie, you’re probably well aware that Gartner recently released its first Magic Quadrant™ for Customer Data Platforms (CDPs). And it’s causing a bit of a stir.

What is Gartner’s Magic Quadrant for Customer Data Platforms (CDPs)?

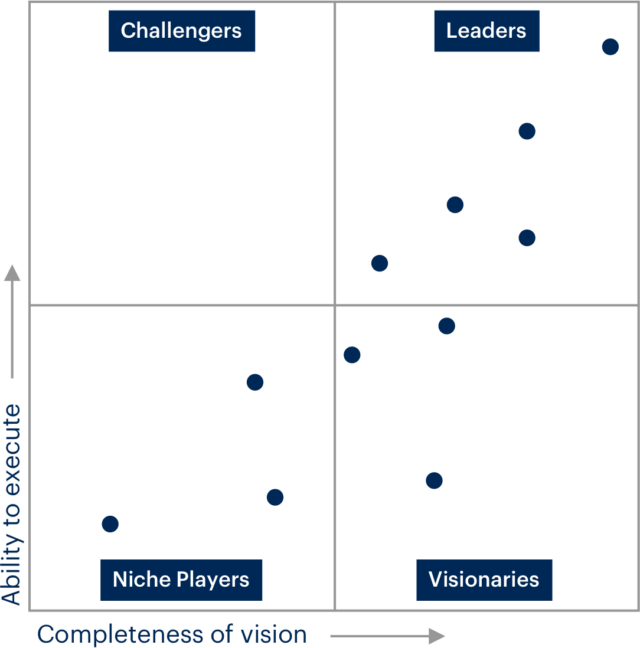

Gartner’s Magic Quadrant has become a mainstay in tech, scoring technology providers against one another to determine their competitive positioning, ultimately categorising them as a Leader, Visionary, Niche Player or Challenger.

However, despite the Magic Quadrant’s well-regarded status, there’s been a lot of chatter amongst CDP players and commentators alike about applying this methodology to the CDP space, with many pointing out inherent flaws in the comparisons. The critiques are interesting when taken at face value, but they’re even more fascinating when looking at the bigger issues within the market itself.

TL;DR: The CDP market has been grappling with its own existential crisis for years, and the Magic Quadrant is exposing the cracks.

To understand the drama, let’s dig into quadrant methodology and results.

Defining Customer Data Platforms (CDPs)

Should be simple enough, right?

“Gartner defines customer data platforms (CDPs) as software applications that support marketing and customer experience use cases by unifying a company’s customer data from marketing and other channels. CDPs optimize the timing and targeting of messages, offers and customer engagement activities, and enable the analysis of individual-level customer behavior over time.”

Gartner explains that CDPS must collect data, unify profiles and enable activation of data for engagement tools. Additional capabilities include segmentation, integrations, data management, privacy and analytic reporting, along with a handful of other “optional” features.

If you’re well versed in CDP lore, you’re probably already starting to feel a bit twitchy reading this.

The CDP landscape is vast, complex and ill-defined. And with significant technological advancements made in the last decade (never mind the last couple of years alone), the CDP market has become more boundless than ever, solidifying itself as the Wild West of Tech.

Cue the score from The Good, The Bad and The Ugly.

CDP Vendor Comparison

“CDP” is used to describe a wide range of technology providers – our platform Unilyze included – but no two CDPs are created equal, making comparison based on a broad set of capabilities all but impossible.

CDPs can fall into a number of categories, so an individual CDP can over-index in certain areas and underperform in others as a result. And that’s not necessarily a bad thing.

Indeed, Gartner itself previously differentiated CDPs across four categories: Marketing Cloud, Smart Hub, Marketing Data Integration, and Engines and Toolkits. These categorisations aren’t perfect – and perhaps that’s why Gartner chose to do away with them – but they highlight differences in the purpose behind the technology. While some were built to ingest and manage data as their primary use case, others are focused on insight or activation. It’s apples and oranges.

Identifying CDP Platform Vendors

Nailing down the exact number of CDP vendors in the marketplace might be as difficult as counting grains of sand on a beach.

There are hundreds of vendors and platforms that could fall into the CDP category, and as mentioned above, they span across different categories and capabilities. Not only this, but the market is further fragmented by size, focus, target market, and so on, so lumping suite vendors like Salesforce and Adobe alongside independents like BlueConic and Amperity further complicates the Magic Quadrant analysis. Not to mention, the analysis fails to take verticals into consideration – not just in terms of retail vs. travel, for example, but even B2C vs B2B.

Again, individual CDPs were created for different purposes, and while the capabilities may overlap, the purpose behind them may not.

The Challenges of the Gartner Magic Quadrant: What It Means for the CDP Market

With all of the complications detailed above, it’s not surprising that the Magic Quadrant for CDPs has left a lot of tech folks scratching their heads, or indeed, taking to their keyboards in protest. Most of the grievances we’ve seen aren’t about the results, per se (although we’ve certainly seen some cutting commentary about the results, too), but rather about the process.

In our opinion, though, the results and process are moot points. The bigger problem is with the industry itself.

Our view of the CDP market

Insights for Marketers on Choosing the Right CDP Vendor

We’ve established that the CDP market is a bit…squirrelly. But what can marketers make of all this?

The biggest takeaway, we believe, is that marketers need to be wary of the “one size fits all” trap. It’s easy to look at the well-known brands on the quadrant and assume they’ll fit seamlessly into your tech stack, accomplishing everything you need them to deliver. But often, that’s not the case, and this is especially true if your core customer data foundation isn’t functional.

Yes, as Gartner suggests, CDPs should be able to unify a company’s customer data from a variety of sources so it can be used across campaigns and channels. But that’s a pretty broad requirement. Prospective buyers need to be brutally honest with themselves about the state of their data before entering the CDP RFP arena, because the marketing and customer experience capabilities a CDP can deliver will only be as good as the data that’s informing them. If your data isn’t connected, clean, matched and accessible, your fancy new activation use cases will fall by the wayside.

Some CDPs have incredibly powerful, low-latency data unification capabilities in addition to their real-time activation and analysis capabilities (hi, Unilyze), while others may need to be combined with a Customer Data Warehouse or a similar platform to achieve your desired results. If your data is already in great shape (good on you!), then you’ll probably find that one of the big-name CDPs will do the job. But if it’s not, don’t assume that any old CDP will fix your underlying data problems.

Sorting out your core data foundation can be a tricky undertaking, but the right partner can streamline the process for you, addressing the root cause of your marketing challenges rather than the symptoms.

Ultimately, marketers need to recognise that CDPs should be fit for purpose. Prospective buyers moseying into this Wild West landscape need to be clear about their data requirements and strategies from the jump. They need to evaluate their existing data infrastructure, prioritize their key use cases and commit themselves to finding the right platform for their business. Enter blindly at your own risk.

What the Magic Quadrant Means for Your Customer Data Strategy

The Magic Quadrant for CDPs revealed a deeply ingrained dilemma that’s been plaguing the industry for years. With all the clarifications the market must make to define itself year after year – a challenge that existed long before Gartner removed any sense of nuance from the CDP competitor landscape to fit its rubric – CDP vendors are themselves causing an endless cycle of confusion and frustration for marketers.

Put simply, a CDP should be able to help marketers quickly and effectively solve key challenges around insight and analysis, personalisation, and campaign targeting and optimisation with unified and accessible customer data.

Plinc’s CDP Solutions

We’ll leave you with this: Whatever CDP you choose, make sure it’s the right fit for your brand.

(If your goal is to use all your customer data to make each customer decision and interaction better, then Unilyze might be the right fit for you.)

Unilyze offers a smarter, more efficient approach to customer data, enabling you to turn insights into meaningful action—let’s talk about how we can help transform your data into decisions. Book a demo to learn more

Blog posts

Measure What Matters: From Campaign Lift to Long-Term Customer Impact

CRM teams won’t earn strategic influence with click rates alone. To drive investment and impact, reporting must shift from campaign metrics to customer…

Lead the Brief: How CRM Becomes a Strategic Voice in Trading Decisions

CRM teams often arrive too late to shape strategy. Showing up with live insight repositions CRM as an contributor to commercial planning , not just the…

Connect the Journey: Building Real Omnichannel Intelligence

Disconnected journeys limit CRM’s impact. When CRM connects cross-channel behaviour into a clear customer view, it drives smarter personalisation,…

Be the Monday Hero: Escape the Reporting Scramble and Get Back to Strategy

Manual reporting keeps CRM teams reactive. Automating performance insight frees them to spot customer trends, guide strategy, and focus on the work that…

Fix the Loyalty Leak: Why Smarter CRM Reduces Margin Loss

Discounts may drive short-term sales, but smarter CRM targets loyalty behaviours that protect margin and build long-term value. Strategic incentives change…

See Beneath the Surface: Turning Segmentation into Strategic Intelligence

Segmentation isn’t just for targeting. When used to surface behavioural insight, it reveals where value is created, what predicts loyalty, and how CRM can…